|

|

|

|

| Form 29-2 (1)

□ Interest

□ Dividends

□ Royalties

□ Other

Application for Tax-Exemption on Non-Resident's Korean Source Income

Provided under the Korea Tax Treaty

□ Corporate Income tax □ Individual Income tax

Processing

Period

Upon

Submission

Beneficiary

① Name

② Resident(Business) Reg. No.

③ Address

④ Resident Country

⑤ Code for Resident Country

Payer

⑥ Name of Corpora.. |

|

|

|

|

|

|

|

| [납세서비스사무처리규정 제32호 서식]

발급번호

Issuance

number

납세사실증명

Certificate of Tax Payment

처리기간

Processing period

즉시

Immediately

성명 (대표자)

Name

주민등록번호

Resident registration number

상호 (법인명)

Name of

company

사업자등록번호

Taxpayer identification number

주소 (본점)

Address

(Head office)

사업장 (지점)

Address(Br.. |

|

|

|

|

|

|

|

| Issue No. 1234

CERTIFICATE OF TAX PAYMENT

Address : #12345, Seocho-dong, Seocho-ku, Seoul-city.

KID No. : 430721 - 1234567

Name in full : KIM, JONG SOO

Location of Taxation : #2345, Seocho-dong, Seocho-ku, Seoul-city.

DESCRIPTION

Tax Item Yr. Term Taxation No. Tax amount Addition

Property Tax 97 1 1234 1,656,910 Tax Item Total Sum

Total Land Tax 97 2 .. |

|

|

|

|

|

|

|

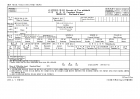

| [Tax Form 24(1)] [2004.3.5.Amended] (page1)

Control

No.

□ Receipt for Wage & Salary Income Taxes Withholding

□ Statement on Wage & Salary Income Payment

(Copy to report by issuer)

Residency

Resident 1/

Non-Resident 2

Nationality

Citizen 1/

Foreigner 9

Application of Flat tax rate

Yes 1/ No 2

State of Residence

State Code

Employer

① Company Na.. |

|

|

|

|

|

|

|

| Control

No.

□ Receipt for Wage & Salary Income Taxes Withholding

□ Statement on Wage & Salary Income Payment

(Copy to report by issuer)

Residency

Resident 1/

Non-Resident 2

Nationality

Citizen 1/

Foreigner 9

Application of Flat tax rate

Yes 1/ No 2

State of Residence

State Code

Employer

①Company Name

②Representative Name

③Tax Reg. No.

④R.. |

|

|

|

|

|

|

|

| [Tax Form 24(1)] (page1)

Control

No.

□ Receipt for Wage & Salary Income Taxes Withholding

□ Statement on Wage & Salary Income Payment

(Copy to report by issuer)

Residency

Resident 1/Non-Resident 2

Nationality

Citizen 1/Foreigner 9

Application of Flat tax rate

Yes 1/ No 2

State of Residence

State Code

Employer

① Company Name

② Representative Name

③ Tax Reg. No.

④ Re.. |

|

|

|

|

|

|

|

| [납세서비스사무처리규정 제3호 서식]

발급번호

Issuance number

납세증명서

Tax Clearance Certificate

처리기간

Processing period

즉시 (단, 해외이주용 10일)

Immediately(Ten days for

Emigration Passport)

납세자

Taxpayer

상호 (법인명)

Name of company

사업자등록번호

Taxpayer

Identification No.

성명 (대표자)

Representative

주민등록번호

Resident Registration.. |

|

|

|

|

|

|

|

| 로봇세 도입 찬성 및 반대에 대해 발표한 자료입니다.

1. 로봇세(Robot Tax) 정의

2. 로봇세 도입목적 및 배경

3. 로봇현황 및 향후 추세

4. 로봇세 도입 찬성

5. 로봇세 도입 반대

6. 결론

7. 참고자료 |

|

|

|

|

|

|

|

| [Form No. 80] (01.3.28. 개정)

Foreign Investment

□Application Form for Tax Reduction or Exemption

□Application Form in regards to a Change in the Content of Tax Reduction or Exemption

Term of Processing

20 Days

Foreign Investor

①Name

②Nationality

③Name of the Foreign Invested Enterprise

④Business Registration No.

Content of

Foreign

Investment

⑤Busine.. |

|

|

|

|

|

|

|

| [Form No. 81] (00.3.30.개정)

Foreign Investment

Application Form for Prior Checking of Tax Reduction or Exemption

Term of Processing

20 Days

Applicant

①Name

②Nationality

③Address

(Telephone No.:)

Content of Application

④Business of Intent

⑤Location

⑥Legal

basis

Pursuant to Article 121-2, Paragraph 1, Item( ) of the Special Tax

Treatment Control Ac.. |

|

|

|

|

|

|

|

| [Form No. 81] (00.3.30.개정)

Foreign Investment

Application Form for Prior Checking of Tax Reduction or Exemption

Term of Processing

20 Days

Applicant

①Name

②Nationality

③Address

(Telephone No.:)

Content of Application

④Business of Intent

⑤Location

⑥Legal

basis

Pursuant to Article 121-2, Paragraph 1, Item( ) of the Special Tax

Treatment Control Ac.. |

|

|

|

|

|

|

|

| [별지 제23호 서식(1)] (99.5.7개정) (제1쪽)

□ 원천징수 영수증 Receipt of Tax withheld

□지급조서 Payment Report

(발행자보고용) (For Report of Issuer)

※관리번호

Control Number

거주구분

Residential Classitication

거주자 1, 비거주자 2

Resident1., Non-Resident 2

내외국인

NativeForeigner

내국인 1, 외국인 2

Native 1, Foreigner 2

징수

의무자

Withholding

Agent

①법인명또는상호

Na.. |

|

|

|

|

|

|

|

| [별지제23호서식(1)](99.5.7개정) (제1쪽)

□ 원천징수 영수증 Receipt of Tax withheld

□지급조서 Payment Report

(발행자보고용) (For Report of Issuer)

※관리번호

Control Number

거주구분

Residential Classitication

거주자 1, 비거주자 2

Resident1., Non-Resident 2

내외국인

NativeForeigner

내국인 1, 외국인 2

Native 1, Foreigner 2

징수

의무자

Withholding

Agent

①법인명또는상호

Name.. |

|

|

|

|

|

|

|

| CERTIFICATE OF VALUE ADDED TAX & SUPPLIED PRICE

Issue Number :

TAX PAYER

Address of Residency :

Address of Establishment :

Telephone Number :

Name of Firm :

Registration Number :

Name of President :

Resident Number :

Kind of Business :

Item of Business :

Usage :

Quantity :

Period Sales(FromTo) Tax Basis(Amount of Income) Item of Tax

Amount of Tax

Month.. |

|

|

|

|

|

|

|

| CERTIFICATE OF LOCAL TAX PAYMENT

Issue No. 518

Please verify that the above mentioned taxation is true and correct.

May 11, 1999

Applicant : 000

To Head official

This is to certify that the above mentioned taxation is true and correct.

July 7, 1999

/S/ Official Seal Affixed

Head Official

Bongchun 7Dong

KwanakGu, Seoul

CERTIFICATE OF LOCAL TAX PAYMENT.. |

|

|

|

|

|